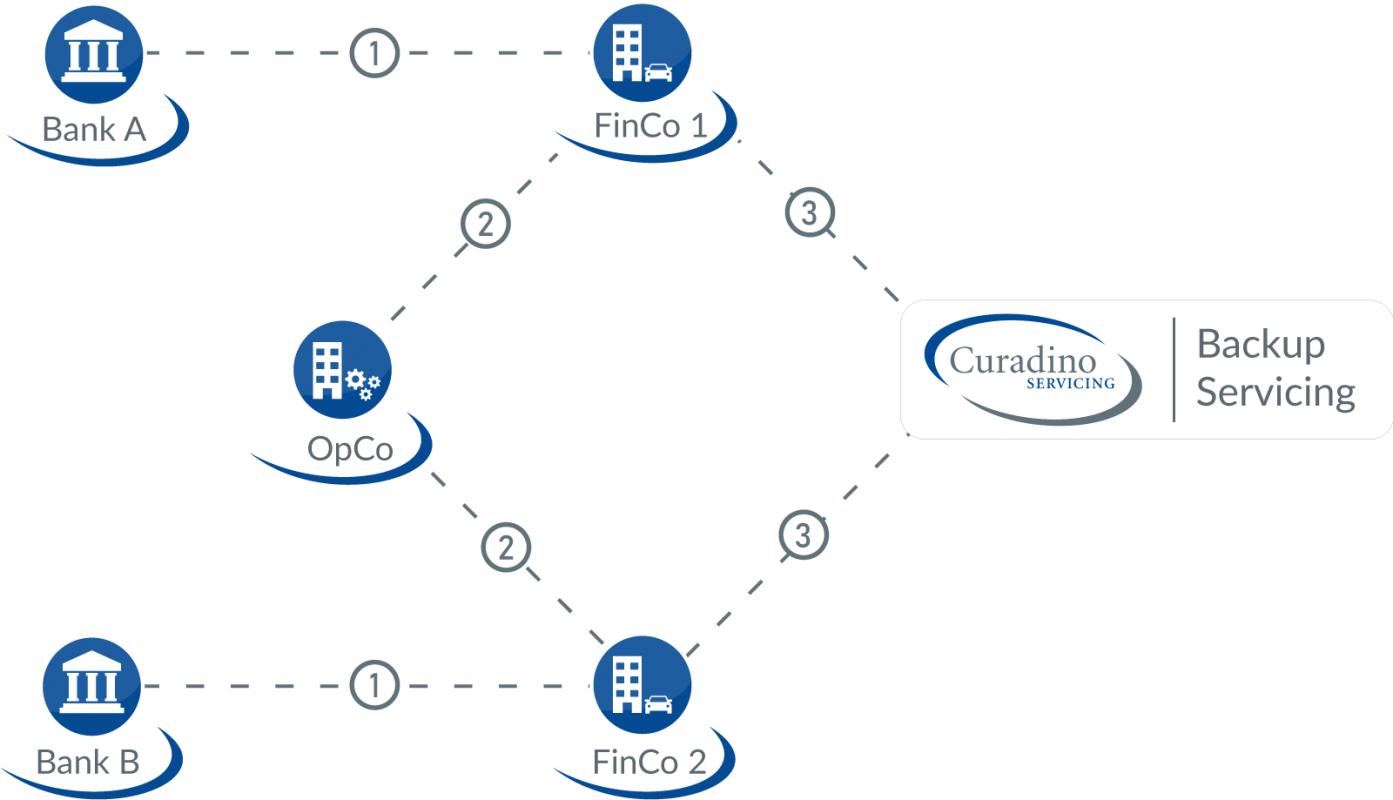

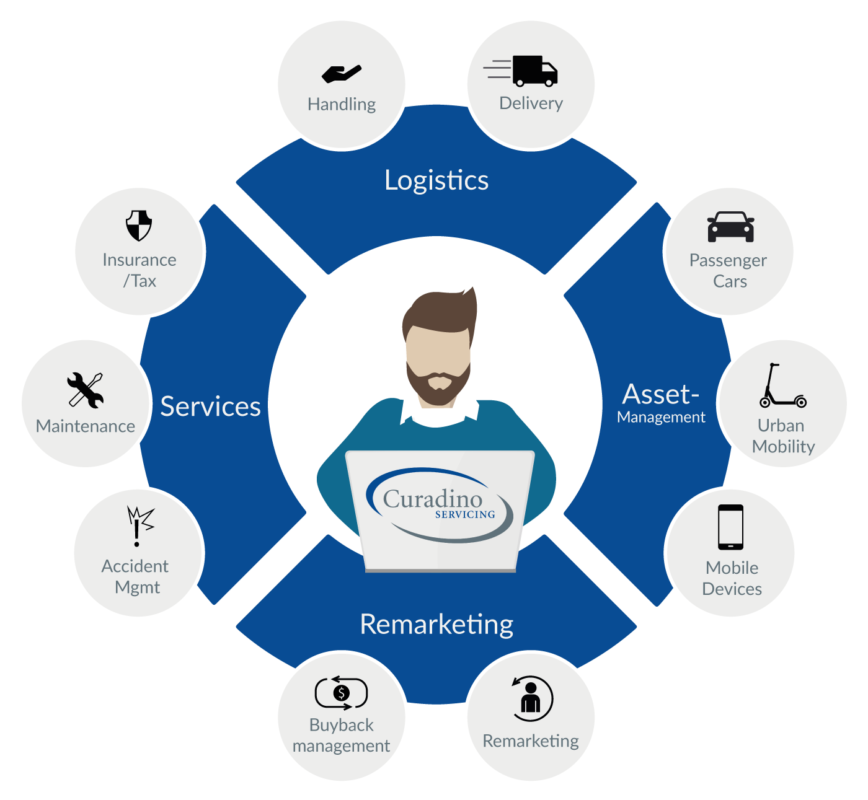

✓ Backup Servicing

Backup servicing for all necessary services in the individually defined depth of your value chain

✓ Minimize risk

Reliable minimization of operational service risks through an excellent network of operational partners

✓ Secure data management

Confidential handling of company data and no disclosure to potential competitors

Deutsch

Deutsch